by Elsa Soto | Feb 21, 2019 | Blog, Buyers, Homeowners, Mortgages, News, Real Estate News

Dear homebuyers: Please stop thinking you need 20% down payment

NEW YORK – Feb. 18, 2019 – First-time buyer surveys consistently show the top hurdle to homeownership is saving up for the down payment. But potential home shoppers may be misunderstanding the amount of money they really need to buy a home.

“Paying 20 percent down is, quite frankly, a myth,” Karen Hoskins, vice president at NeighborWorks, told HouseLogic. “Most buyers pay only 5 percent to 10 percent down – some even pay zero.”Several assistance programs can help buyers with down payment concerns break into homeownership. For example, 69 percent of about 2,500 homebuying programs tracked by Down payment Resource offer down payment assistance. The average amount of assistance from these programs tops $11,000.

HouseLogic offers several places where buyers can search for down payment assistance, including through national government programs. The Federal Housing Administration offers loans to first-time buyers with down payments as low as 3.5 percent. Programs like the USDA Rural Development Loans and VA Home Loans offer eligible buyers zero-down payment loans. Mortgage financing giants Fannie Mae and Freddie Mac offer eligible buyers loans where they can put down as little as 3 percent of the purchase price.

When buyers put down less than 20 percent, they pay private mortgage insurance (PMI) each month to protect the lender’s interest, though the PMI can often be cancelled once they build up 20 percent equity in the property. Many state and local homebuying programs offer assistance programs too. There are many different forms of assistance, such as forgivable loans and grants (gifts for some or all of the down payment and closing costs) to soft mortgages (down payment assistance loans that are deferred for some period of time based on the program’s requirements).

Mortgage brokers should also be able to supply buyers with information about programs in their area and help determine eligibility.

SOURCE: © 2019 Florida Realtors®

by Elsa Soto | Jan 29, 2019 | Blog, Homes, Villas and Condos, Local Events, Mortgages, Real Estate Components, Real Estate News

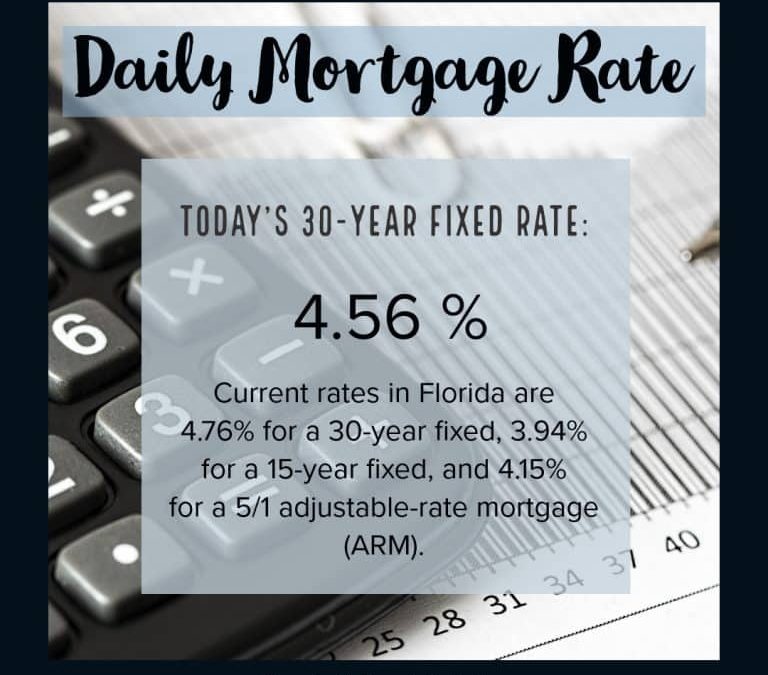

Central Florida’s Daily Mortgage Rates

Welcome to this weeks snapshot of Central Florida Daily Mortgage Rates! Does your New Year’s Resolution include spending time to invest your hard earned money into something that will continue to reward you, especially with ownership? Well, it should!!

BREAKING DOWN ‘Mortgage Rates’

The mortgage rate is a primary consideration for homebuyers looking to finance a new home purchase with a mortgage loan. Other factors also involved include collateral, principal, interest, taxes and insurance. The collateral on a mortgage is the house itself, and the principal is the initial amount for the loan. Taxes and insurance vary according to the location of the home and are usually an estimated figure until the time of purchase.

Source: Investopedia.com

Each mortgage rate is determined by the lender and can be either fixed, staying the same for the term of the mortgage, or variable, fluctuating with a benchmark interest rate. A mortgage rate may vary for borrowers based on their credit profile. Here is a snap shot of the daily mortgage rates as of today, Tuesday, January 29, 2019. While the rates shown are not guaranteed for everyone, this gives the average buyer a good idea of what their rate should look like. We always recommend you speak with your local realtor to find the best loan program for your Orlando Home purchase. Take advantage of these mortgage rates now before it changes, contact us today by clicking on the ‘contact us’ link or by filling out the form above!

Source: Bank Rate

by Elsa Soto | Jan 21, 2019 | Blog, Homeowners, Mortgages, News, Real Estate News

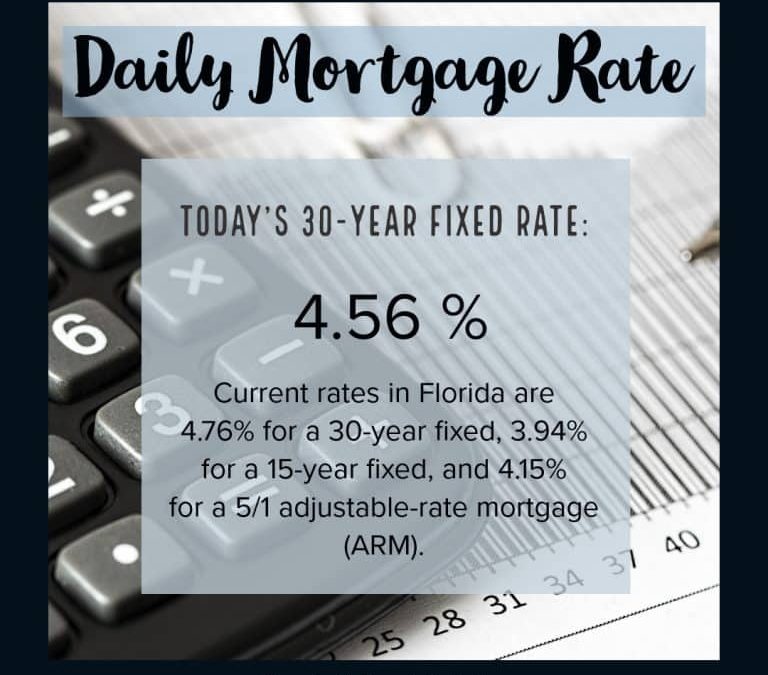

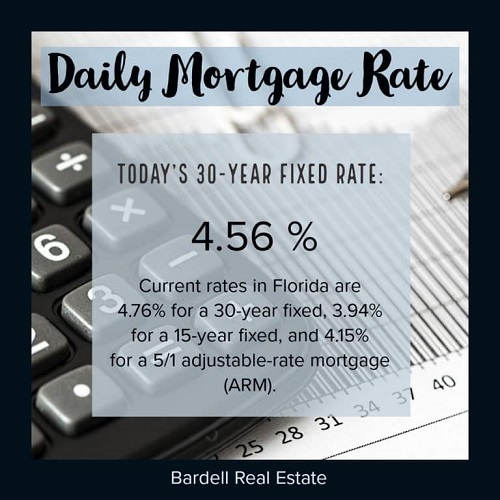

Central Florida’s Daily Mortgage Rates

Welcome to this weeks snapshot of Central Florida Daily Mortgage Rates! Does your New Year’s Resolution include spending time to invest your hard earned money into something that will continue to reward you, especially with ownership? Well, it should!!

BREAKING DOWN ‘Mortgage Rates’

BREAKING DOWN ‘Mortgage Rates’

The mortgage rate is a primary consideration for homebuyers looking to finance a new home purchase with a mortgage loan. Other factors also involved include collateral, principal, interest, taxes and insurance. The collateral on a mortgage is the house itself, and the principal is the initial amount for the loan. Taxes and insurance vary according to the location of the home and are usually an estimated figure until the time of purchase.

Source: Investopedia.com

Mortgage rates are determined by the lender and can be either fixed, staying the same for the term of the mortgage, or variable, fluctuating with a benchmark interest rate. Mortgage rates may vary for borrowers based on their credit profile. Here is a snap shot of the daily mortgage rates as of today, Monday, January 21, 2019. While the rates shown are not guaranteed for everyone, this gives the average buyer a good idea of what their rate should look like. We always recommend you speak with your local realtor to find the best loan program for your Orlando Home purchase. Take advantage of these mortgage rates now before it changes, contact us today by clicking on this link or by filling out the form above!

Source: Bank Rate

by Elsa Soto | Dec 31, 2018 | Blog, Buyers, Homeowners, Mortgages, News, Real Estate Components

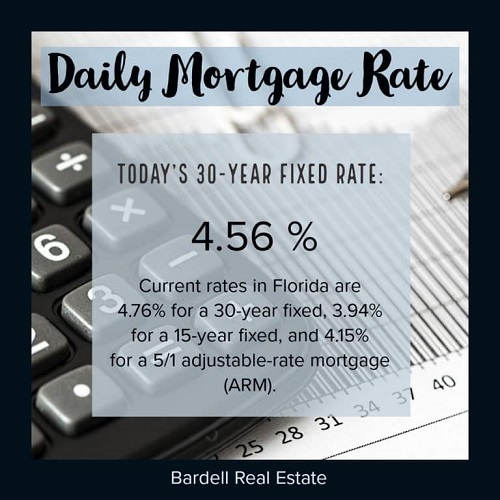

Central Florida’s Daily Mortgage Rates

Welcome to this weeks snapshot of Central Florida Daily Mortgage Rates! Does your New Year’s Resolution include spending time to invest your hard earned money into something that will continue to reward you, especially with ownership? Well, it should!!

consideration for homebuyers looking to finance a new home purchase with a mortgage loan. Other factors also involved include collateral, principal, interest, taxes and insurance. The collateral on a mortgage is the house itself, and the principal is the initial amount for the loan. Taxes and insurance vary according to the location of the home and are usually an estimated figure until the time of purchase.

Source: Investopedia.com

Each mortgage rate is determined by the lender and can be either fixed, staying the same for the term of the mortgage, or variable, fluctuating with a benchmark interest rate. A mortgage rate may vary for borrowers based on their credit profile. Here is a snap shot of the daily mortgage rates as of today, Monday, November 12, 2018. While the rates shown are not guaranteed for everyone, this gives the average buyer a good idea of what their rate should look like. We always recommend you speak with your local realtor to find the best loan program for your Orlando Home purchase. Take advantage of these mortgage rates now before it changes, contact us today by clicking on this link or by filling out the form above!

Source: Bank Rate

by Elsa Soto | Dec 19, 2018 | Blog, Buyers, Mortgages, News, Real Estate Components, Real Estate News

WASHINGTON – Dec. 17, 2018 – The Federal Housing Administration (FHA) announced the agency’s new schedule of loan limits for 2019, with most areas in the country to experience an increase in loan limits in the coming year. These loan limits are effective for FHA case numbers assigned on or after Jan. 1, 2019 and mirror earlier limits announced by the Federal Housing Finance Administration (FHFA).

In high-cost areas of the country, FHA’s loan limit ceiling will increase to $726,525 from $679,650. FHA will also increase its floor to $314,827 from $294,515.

FHA says that increases in median housing prices required changes to FHA’s floor and ceiling limits, which are tied to the Federal Housing Finance Agency (FHFA)’s increase in the conventional mortgage loan limit for 2019.

Overall, the maximum loan limits for FHA forward mortgages will rise in 3,053 U.S. counties. In 181 counties, FHA’s loan limits will remain unchanged.

By statute, the median home price for a Metropolitan Statistical Area (MSA) is based on the county within the MSA having the highest median price. HUD has used the highest median price point for any year since the enactment of the Housing and Economic Recovery Act (HERA).

The cap for reverse mortgages – FHA-insured Home Equity Conversion Mortgages (HECMs) – will increase to $726,525 from $679,650. FHA’s current regulations implementing the National Housing Act’s HECM limits do not allow loan limits for reverse mortgages to vary by MSA or county.

The National Housing Act, as amended by HERA, requires FHA to establish floor and ceiling loan limits based on the loan limit set by FHFA for conventional mortgages owned or guaranteed by Fannie Mae and Freddie Mac. FHA’s 2019 minimum national loan limit, or floor, of $314,827 is set at 65 percent of the national conforming loan limit of $484,350. This floor applies to those areas where 115 percent of the median home price is less than the floor limit.

Any areas where the loan limit exceeds this ‘floor’ is considered a high-cost area, and HERA requires FHA to set its maximum loan limit ‘ceiling’ for high-cost areas at 150 percent ($726,525) of the national conforming limit.

© 2018 Florida Realtors®

Source: Florida Realtors

by Elsa Soto | Nov 26, 2018 | Blog, Buyers, Homeowners, Mortgages, News, Property for Sale in Orlando, Real Estate News

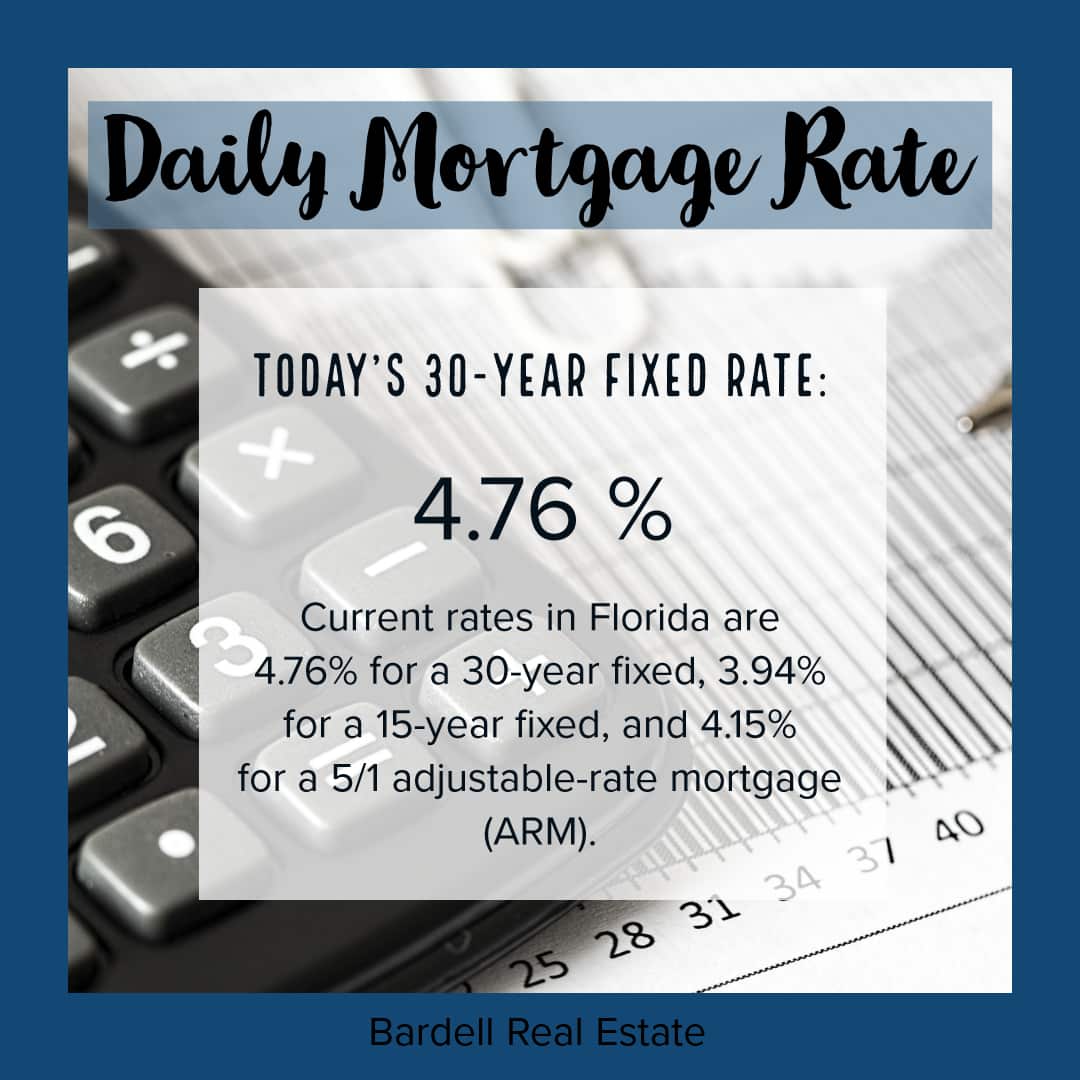

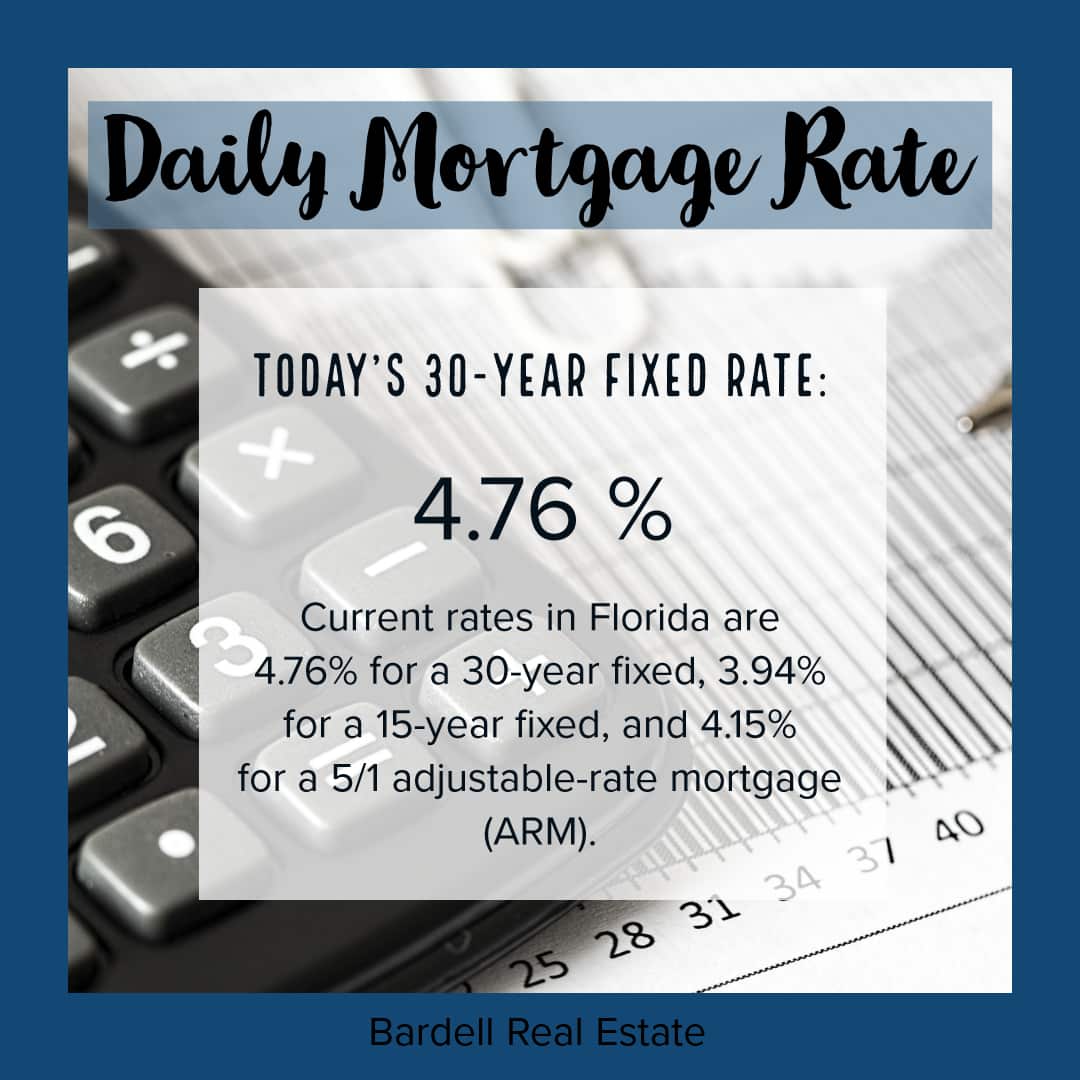

Central Florida’s Daily Mortgage Rates

Welcome to this weeks snapshot of Central Florida Daily Mortgage Rates! Now has never been a better time to invest your hard earned money into something that will continue to reward you, especially with ownership!

BREAKING DOWN ‘Mortgage Rates’

The mortgage rate is a primary consideration for homebuyers looking to finance a new home purchase with a mortgage loan. Other factors also involved include collateral, principal, interest, taxes and insurance. The collateral on a mortgage is the house itself, and the principal is the initial amount for the loan. Taxes and insurance vary according to the location of the home and are usually an estimated figure until the time of purchase.

The mortgage rate is a primary consideration for homebuyers looking to finance a new home purchase with a mortgage loan. Other factors also involved include collateral, principal, interest, taxes and insurance. The collateral on a mortgage is the house itself, and the principal is the initial amount for the loan. Taxes and insurance vary according to the location of the home and are usually an estimated figure until the time of purchase.

Source: Investopedia.com

Each mortgage rate is determined by the lender and can be either fixed, staying the same for the term of the mortgage, or variable, fluctuating with a benchmark interest rate. A mortgage rate may vary for borrowers based on their credit profile. Here is a snap shot of the daily mortgage rates as of today, Monday, November 12, 2018. While the rates shown are not guaranteed for everyone, this gives the average buyer a good idea of what their rate should look like. We always recommend you speak with your local realtor to find the best loan program for your Orlando Home purchase. Take advantage of these mortgage rates now before it changes, contact us today by clicking on this link or filling out the form above!

Source: Bank Rate